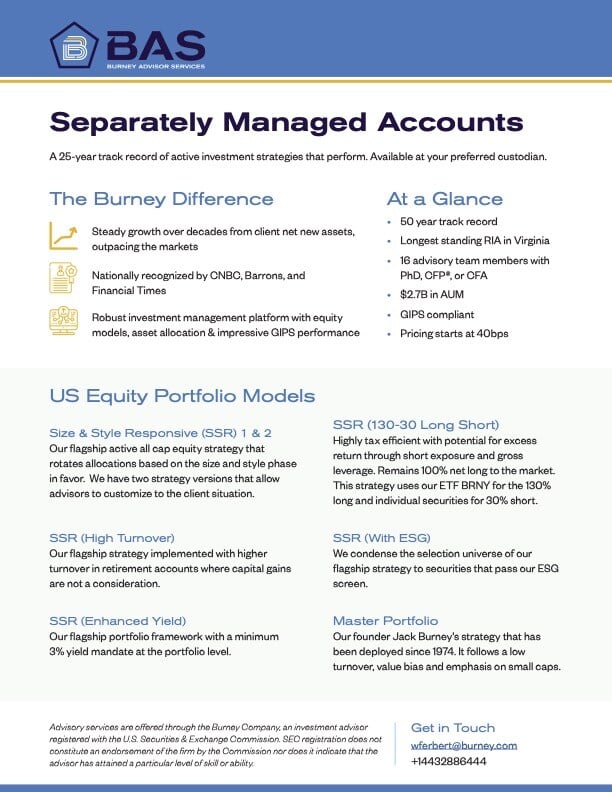

A 25-year track record of active investment strategies to enhance your client portfolios

US Equity Portfolio Models

Our flagship active all cap equity strategy that rotates allocations based on the size and style phase in favor. We have two strategy versions that allow advisors to customize to the client situation.

Highly tax efficient with potential for excess return through short exposure and gross leverage. Remains 100% net long to the market. This strategy uses our BRNY ETF for the 130% long and individual securities for 30% short.

Key Service Benefits

Our centralized model and custom trading operation, managed by two CFAs enables you to leverage tax-sensitive transition trading for your clients.

Additionally, we provide routine cash management for clients requiring ongoing or one-time distributions, ensuring liquidity is managed efficiently and effectively.

Create a custom result for your clients by mixing and matching our US equity strategies based on the desired risk-return profile.

Offer a sophisticated portfolio to your higher net-worth clients, tailored to their specific needs and objectives.

Connect with a vibrant community of advisors through dedicated Slack channels, webinars, and in-person events.

Combined with our committee’s daily market commentary and insights that can be repurposed for your clients, advisors can quickly interpret complex market data and trends.

Fees & Pricing for our SMA Service

Our SMA service is priced starting at 40 bps.

This fee includes

- transition support

- proprietary equity SMAs

- market commentary & investment research

- model portfolio management & rebalancing

- tax-sensitive transition trading.

Resilient, robust client portfolios start with the right partner

If you’re ready to see how our SMA service can enhance your client portfolios, here’s how the process works.

- Meet: Together, let’s discuss your goals, challenges, and what makes your practice unique to find out if Burney Advisor Services is the right fit for your business.

- Transition: We’ll create a comprehensive integration plan, setting you up for a smooth transition.

- Launch: You spend more time nurturing client relationships and less time worrying about your investment management.

Schedule a talk with a member of our investment team.