Summary

- So far the impacts have been limited and benign.

- Tariff proceeds hit a record.

- No fallout on inflation, growth and consumers.

- No change in on-shore investment or manufacturing jobs.

- China emerged as a notable loser: both its economy and exports to the U.S. have been hurt.

- Impositions continue to evolve, and their full effects are still unfolding.

- Peak Impact Expected in the fourth quarter.

- These short-term outcomes reinforce our data-driven, rather than perception-driven, investment approach.

It’s been (almost) six months since Liberation Day, when President Trump announced sweeping tariffs that jolted financial markets. We take a look at how things have played out so far, from the U.S. perspective.

Highest Average U.S. Tariff Rate Since WWII

After the initial chaos and rounds of negotiation, the average tariff rate eased following Liberation Day, yet it still stands at the highest level since World War II.

Additional tariffs continue to be introduced, leaving the situation fluid.

Historical Hauls

Tariff proceeds spiked. From April to August, net customs duties totaled $129 billion, compared to $38 billion over the same period last year.

Economy Holds Ground

Inflation saw a small uptick; Real growth remains stable.

Q3 real GDP is expected to grow at an annualized rate of 3.9%.

Consumers Are In Good Shape

Levies have yet to hit consumers’ pockets.

Q2 GDP and consumption just got revised up yesterday and real disposable income grew 3.1% in the quarter, giving Americans more spending power.

Stocks Rally

Since Liberation Day, the NASDAQ has gained 44%, emerging markets 35%, the S&P 500 31%, and developed markets 27%. Over the trailing 1-yr, these indexes have advanced 12–24% and are all at their highest levels.

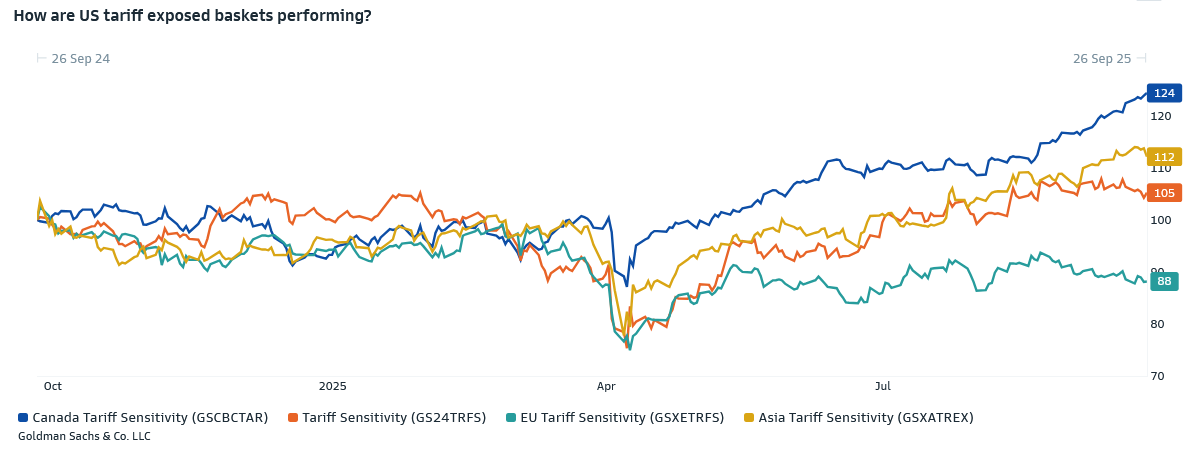

However, the effects among tariff-exposed stocks have been uneven:

Canadian stocks have risen, U.S. stocks have only just recovered to their January levels, and European stocks remain underwater.

Record U.S. Stocks Held by Foreigners

International investors have shown no signs of protesting U.S. equities: they have snapped up AI stocks and now hold roughly 30% of the nearly $60 trillion market.

No Output Losses in Manufacturing and Agriculture

Forecasted manufacturing and agriculture production losses from tariffs in earlier studies, including Peterson's, have yet to surface: in Q2, agriculture output was flat, while manufacturing output picked up slightly.

No Manufacturing Job Gains Either

President Trump touted tariffs as a way to bring manufacturing jobs back, while his opponents argued they would cost jobs. To date, there is no clear winner in this debate.

Tariffs Haven't Spurred Investments

Q2 saw no increase in domestic investment year-over-year.

Trade Volume Unfazed

Despite increased volatility that was largely driven by pharmaceutical and gold trades,

there has been no shock to trade volumes.

China's Share Slips

In Q2, China’s share of U.S. imports declined significantly, though this appears to be part of a multi-year trend. Mexico’s share increased during the quarter, while shares from other major exporting countries remained stable.

Chinese Economy Hurt

There are unrelated structural changes in the Chinese economy, but tariffs have no doubt contributed to slowing China’s economic growth.

Final Thoughts

Tariff impacts have been limited and benign so far. They will continue to evolve and unfold.

The fact that the anticipated downside has not materialized over the past six months may have surprised some market observers, but this very outcome reinforces our disciplined data-driven investment approach: respond to substantiated changes, not to initial hype.

Please check back in six months for our one-year review.