Summary

- AI stocks continue to push the market to all-time highs, but the average stock is down in October.

- There is wide dispersion across sectors and between AI and non-AI stocks.

- High beta and momentum continue to be the leading factors.

- M7’s leadership is underpinned by profitability, in contrast to the speculative froth developing in the Russell 2000.

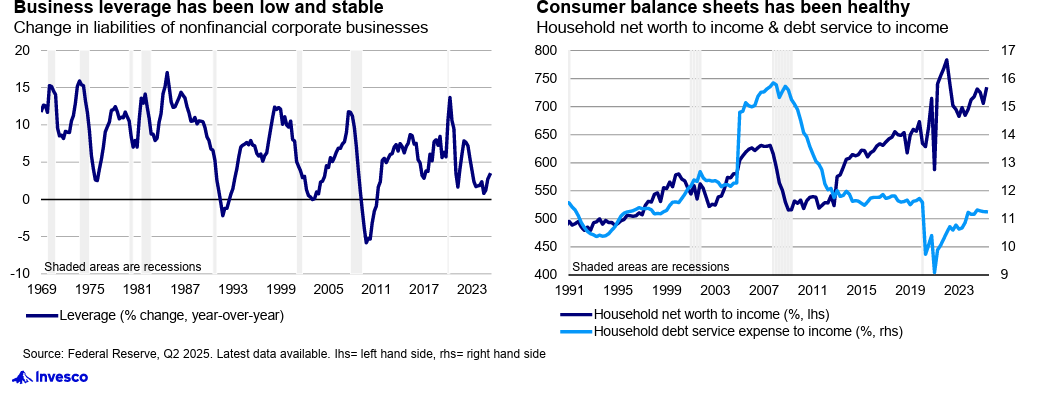

- Healthy business and consumer fundamentals reinforce a supportive macro backdrop.

Overall Market - Not a Rally for Everyone

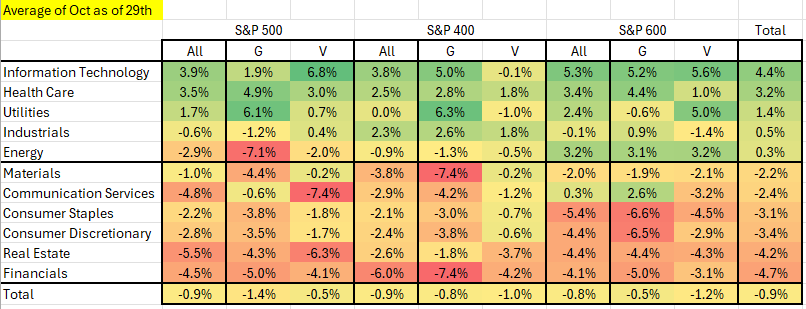

MTD in October, 47% of the Nasdaq 100 and 60% of stocks across the S&P 500, S&P 400, S&P 600, and S&P 1500 are in the red. Non-microcap stocks have averaged a return of -0.9%, with greater dispersion observed across sectors than across size or style categories.

(Source: S&P; BAS calculation)

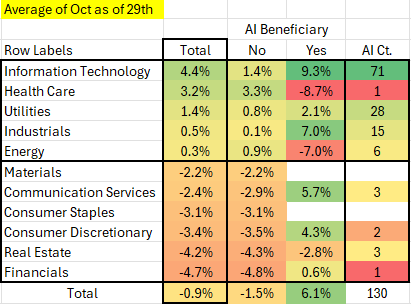

AI stocks continue to be the overachievers in this market, returning an average of 6.1%.

The majority of these names are in the Technology sector, followed, at a distance, by Utilities.

(Source: S&P; Goldman Sachs AI Baskets; BAS calculation)

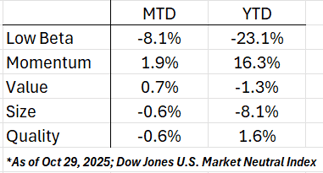

Factors - High Beta and Momentum Dominate

Sentiment remained risk-on in October, with momentum continuing to build.

YTD, high-beta stocks have significantly outperformed, as have those with strong momentum.

In contrast, investors have shown little preference for style or quality factors.

The Magnificent Seven

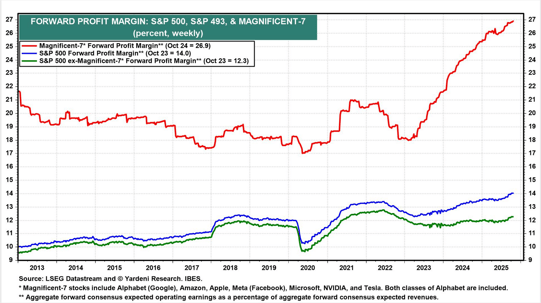

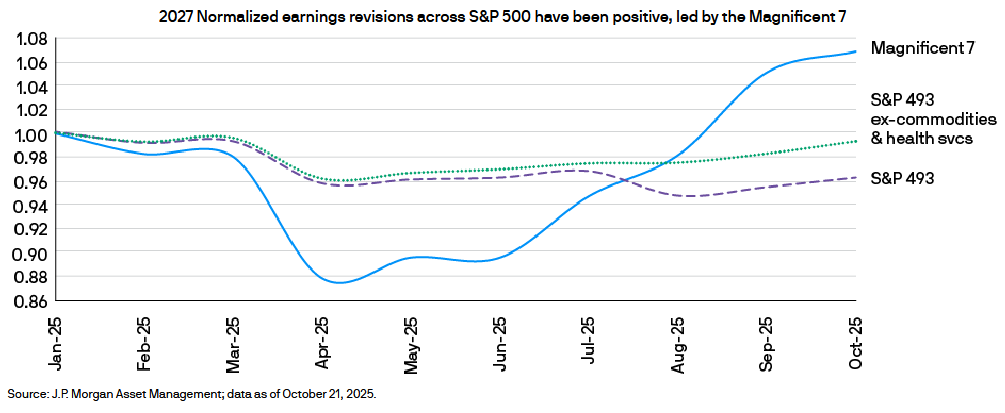

These names drive the market because they contribute disproportionately to overall profitability.

Investors are more rational than many believe:

earlier this year, when earnings revisions for the M7 were trending downward, their performance lagged. As revisions turned positive, these stocks caught up and outperformed.

In essence, this remains an earnings-driven market.

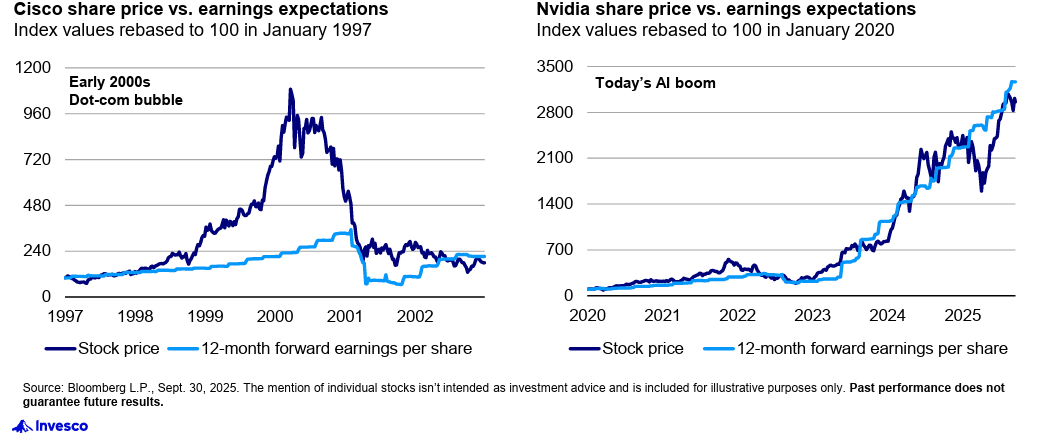

2000-like Bubble? Not in Tech

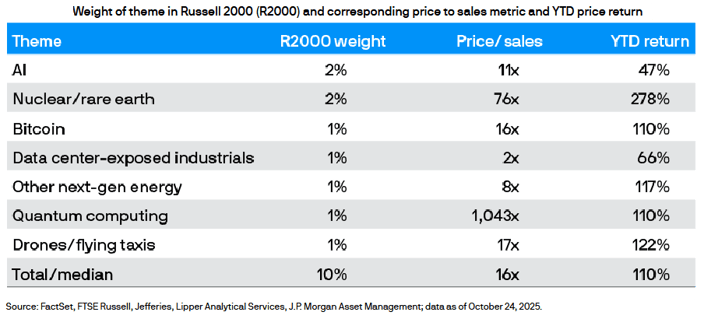

Small caps, however, are starting to look frothy. We know that the Russell 2000 is dominated by unprofitable companies. Its performance is now driven by meme and theme stocks.

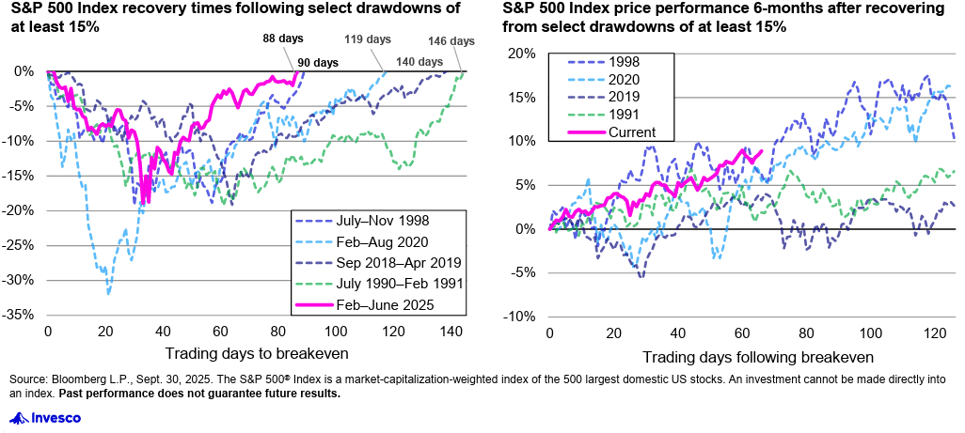

Young Bull

The runway may be longer than many expect.

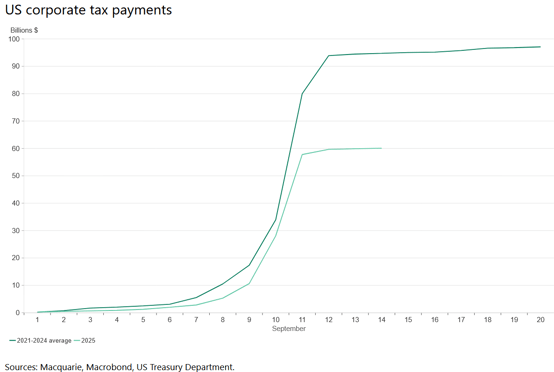

Macro

Companies are now paying less in taxes, which will flow through to earnings.

Business and consumer balance sheets remain healthy.

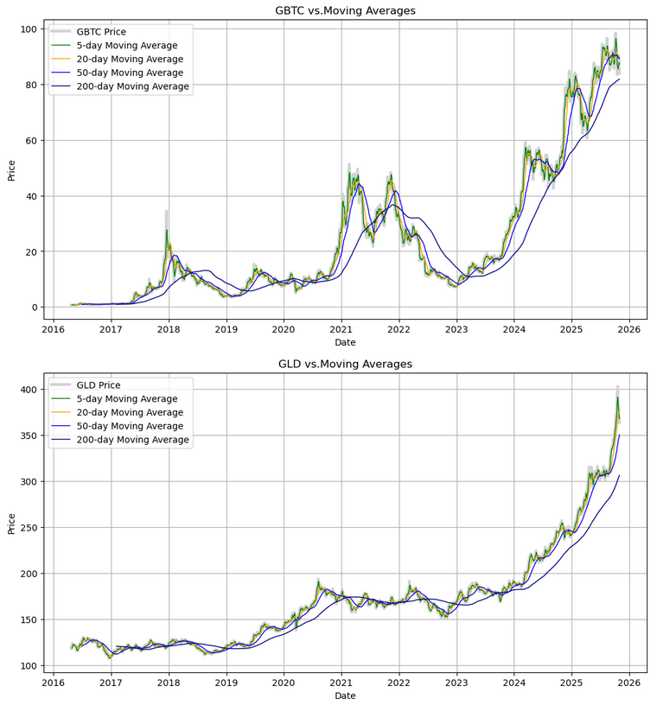

Bitcoin and Gold

Both have had a tremendous run since 2023.

Bitcoin is currently in a consolidation phase,

while gold has pulled back sharply but remains in a strong uptrend.

(Source: Yahoo Finance; BAS calculation)

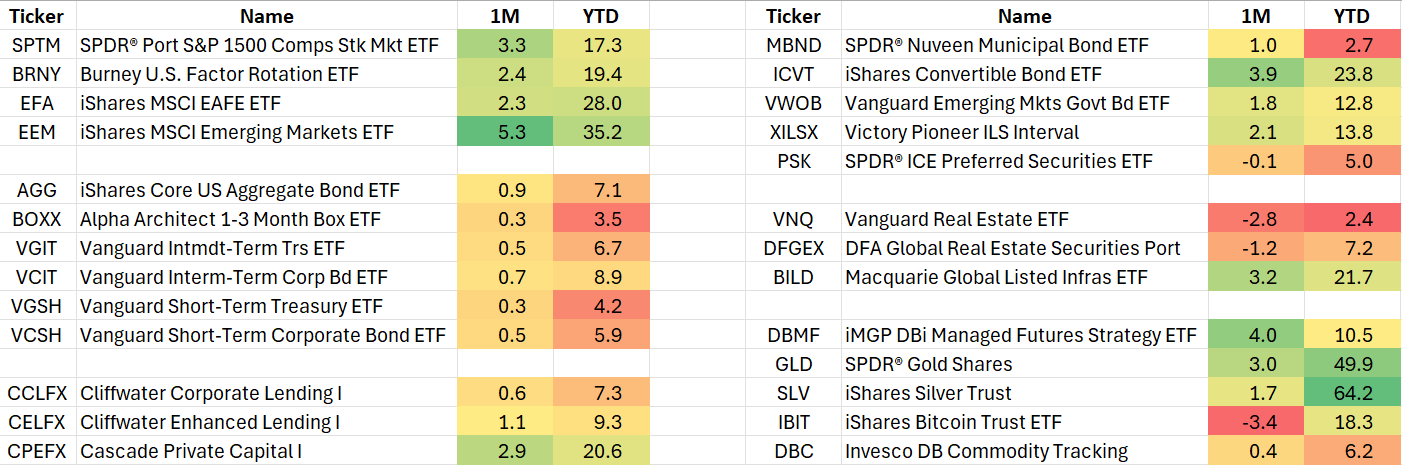

Asset Returns

YTD equities have delivered strong returns. EM continues to outperform.

Outside of traditional assets, convertible bonds, EM debt, infrastructure, and precious metals have all been significant gainers.

(Source: Morningstar; BAS calculation)