What Didn't Happen?

"The Year of the Bond"

Stocks greatly outperformed bonds in 2023. Bonds barely beat cash.

SPY: 26.7%

HYG: 11.3%

AGG: 5.0%

BIL: 4.9%

TLT: 0.8%

"Recession"

Core PCE declined from 4.4% to 3.2% (Nov) in 2023, but the Unemployment Rate remained low, and real GDP progressed from 0.7% in 2022Q4 to 2.9% in 2023Q3 (2.4% expected for 2023Q4).

(All percentages are trailing 12-month changes).

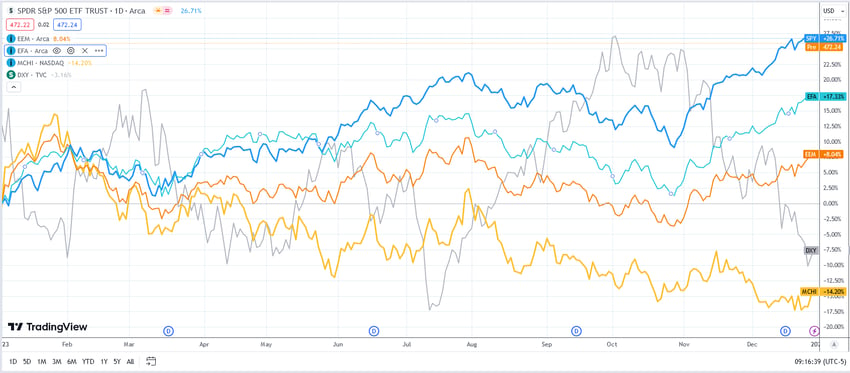

"A China Rebound"

Chinese stocks fell nearly 60% from the early 2021 peak due to a post-Covid economic recovery that failed to materialize. EM and developed stocks also underperformed.

SPY: 26.7%

EFA: 17.3%

EEM: 8.0%

MCHI: -14.2%

"Volatility Spike"

Despite a brief rise during the regional bank crisis in March, both stock and bond volatilities ended the year lower.

What Did Happen?

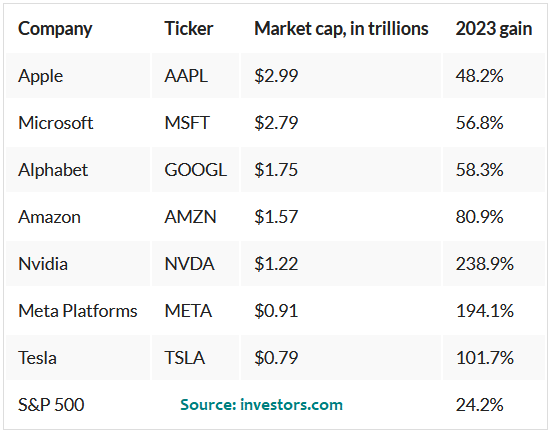

The Magnificent Seven

AI boosted the investment case for tech.

A Round Trip for Large-caps

The Dow, the S&P 500, and the NASDAQ 100 successfully recouped their losses stemming from the Fed's rate hikes, with the Russell 2000 trailing behind in the recovery.

Year-end Small-cap Catch-up

Market breadth saw a notable improvement in the final two months of 2023.

QQQ: 55.9%

SPY: 26.7%

IWM: 17.5%

RSP: 13.8%

What's Next?

Yield Curve Un-inversion Risk

The yield curve un-inversion will have a positive impact on stocks if the Fed declares victory in its battle against inflation and slashes the federal funds rate sooner rather than later. Alternative scenarios involve rate cuts on the brink of a recession and/or increases in the 10-year rate, both of which will exert pressure on stocks.

Weaker Consumers

Personal saving rate has reached its lowest point since the GFC, concurrently with debt service payments returning to pre-Covid levels. Consumers are expected to pull through, but spending will not be as strong as before.

Margin Recovery?

As inflation declines and wages remain rigid, corporate profit margins may struggle to recover, although productivity improvements could come to the rescue.

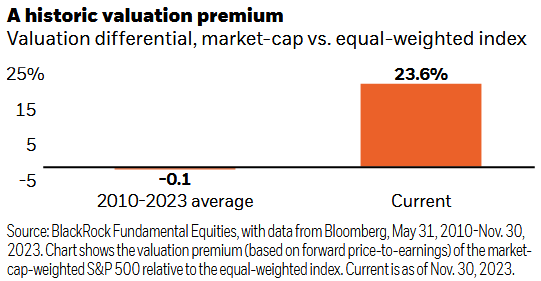

Valuation Gap Closure

Valuation Gap Closure

Absence of a recession, market breadth should continue to broaden out. At some point, the valuation gaps between the cap-weighted index and the equal-weighted index need to be closed.