Attribution Summary

In November, the strategy returned +1.34%, outperforming the Russell 3000’s +0.27% return. This month’s results were driven by positive stock selection and a strong interaction effect, partially offset by unfavorable size and style positioning. Below is a breakdown of the performance attribution:

-

Market Return: +0.30%

-

Size & Style Effects: -0.50%

-

Stock Selection Effect: +0.30%

-

Interaction Effect: +1.20%

-

Strategy Return: +1.30%

Size & Style Allocation: No Change

Our size and style allocation guidance remains unchanged.

In November, our size and style allocation decisions modestly hurt performance. While our slight lean toward non-large companies was beneficial—particularly given our overweight to value within non-large caps—our large-cap sleeve is tilted toward growth, which struggled during the month. This led to Size & Style underperformance relative to the benchmark.

We were able to offset some of this drag through stock selection, but the underlying size and style tilts were still a headwind versus the Russell 3000.

We continue to hold a slight growth tilt overall and an overweight to large-cap exposure. Small & Mid exposure remains modest, but we continue to monitor signals across size and style.

Size & Style Allocation Guidance (unchanged)

Overall Portfolio

Style Within Size Groups

-

Lg: 40% Value / 60% Growth

-

SMID: 70% Value / 30% Growth

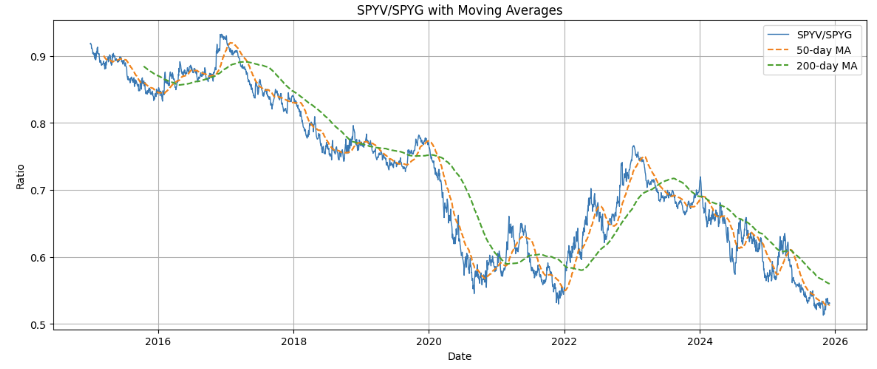

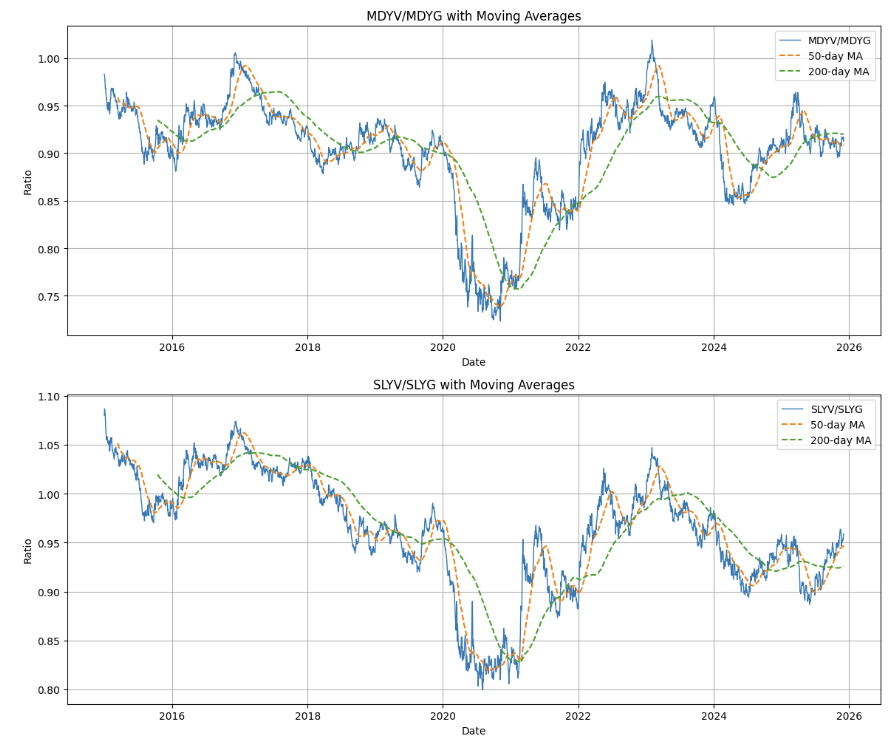

Technical Signals

Our technical view remains mixed, with no strong conviction on a structural shift in size or style, despite November’s moves.

-

Size: Even with strong small- and mid-cap performance in November, the long-term size signal still does not show a decisive trend toward either large or smaller companies.

-

Large Cap Style: November saw a short-term uptick in value, but the longer-term trend still favors growth in large caps.

-

Mid Cap Style: Signals remain neutral in mid caps, with no clear advantage for value or growth.

-

Small Cap Style: Continues to show value leadership, a shift we had anticipated and are already positioned for via our modest value tilt within small caps.

Stock Selection

In contrast to earlier in the year, November saw a broadening of performance beyond the “Magnificent 7,” as the risk-on / recovery rally has largely faded and returns began to spread across a wider set of names.

Our signals showed strong effectiveness in November, and this translated into positive stock selection alpha:

-

Positive contributors included Expeditors International (EXPD), UGI (UGI), and Alphabet (GOOGL).

-

While a handful of positions detracted, overall stock selection was a positive, and the pattern of winners and losers was consistent with where our signals have been pointing.

The interaction effect—the combined impact of where we allocate capital (size/style tilts) and which stocks we select inside those buckets—also added value. In practical terms, this means we not only owned the “right” stocks, but also sized them appropriately within the right segments, amplifying the contribution from successful positions.

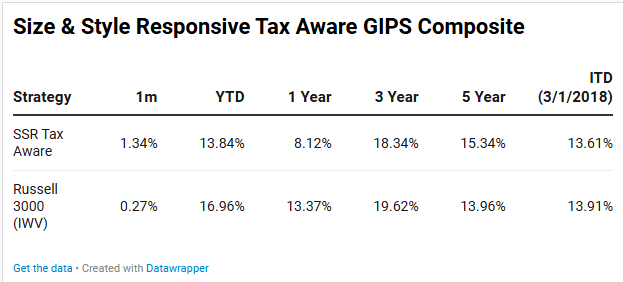

GIPS Composite Performance

As of November 30, 2025, the Size & Style Responsive Tax-Aware strategy has returned 13.84% YTD, compared to the Russell 3000’s 16.96%. While the strategy outperformed the benchmark this month, it remains behind on a YTD, 1-year, and 3-year basis. Over a 5-year horizon, however, the strategy has meaningfully outperformed its benchmark, and since inception the performance of the strategy and benchmark has been very close and not materially different.

Compliance Disclosure:

The Size and Style Responsive Tax-Aware strategy seeks to manage after-tax returns by incorporating tax considerations into trade decisions. For example, when possible, the strategy may defer realizing short-term gains to achieve long-term tax treatment, subject to client-specific constraints and objectives. Tax impact is a factor in implementation, but it does not override the strategy’s investment objectives.

Past performance, whether actual or hypothetical, does not guarantee future performance. Investment results and principal value will fluctuate, and clients' investments, when redeemed, may be worth more or less than their original cost. This communication is exclusively for investment advisors and financial professionals and is not intended for clients or the investing public.