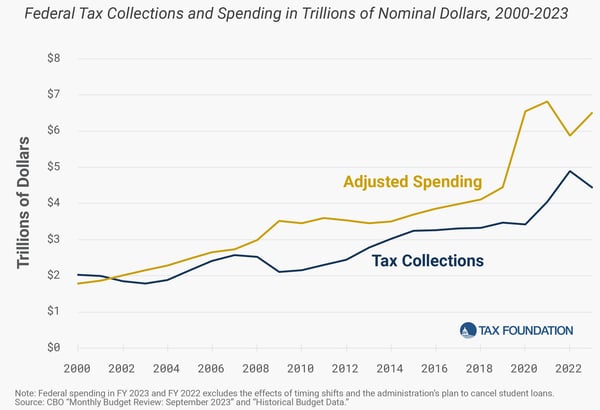

(Note: the second chart is linked to FRED which is yet to be updated with the FY2023 number).

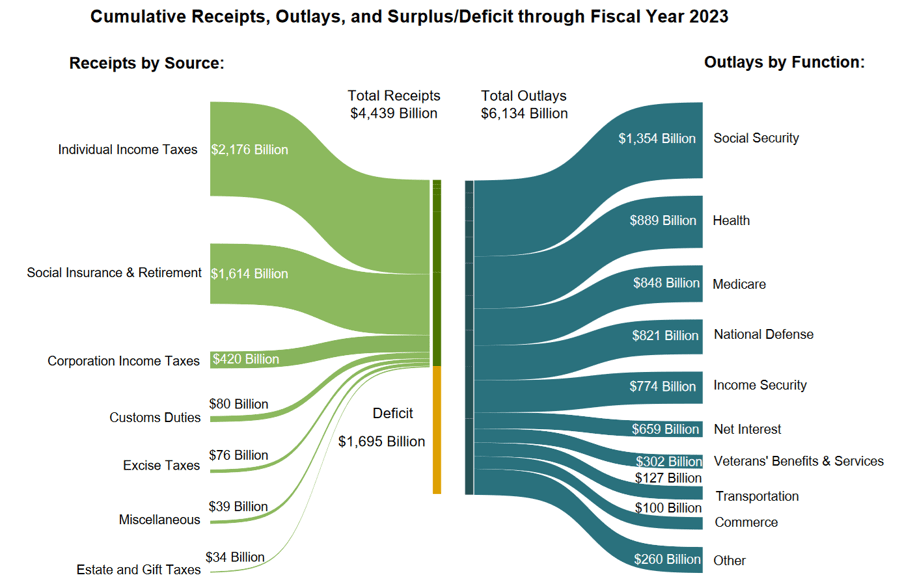

The U.S. closed out fiscal year 2023 in September with a deficit of $1.7 trillion, marking the third largest in history, following 2020 ($3.1 trillion) and 2021 ($2.8 trillion).

Other than the COVID era, the current deficit-to-GDP ratio of 6.3% is surpassed only by those seen during the WWII era (7.0% to 29.6%) and the GFC era (6.7% to 9.7%).

When factoring out an accounting mirage related to the overturned student-loan forgiveness program, the deficit doubled in the past year, increasing from $1 trillion in 2022 (reported as $1.4 trillion) to $2 trillion in 2023 (reported as $1.7 trillion).

Tax receipts slumped by 9.3%, almost entirely attributable to a $456 billion decline in individual income taxes. Net interest payments increased by $200 billion due to the Fed's aggressive rate hikes. Additionally, spending on green initiatives, defense, and a surge in claims for expiring pandemic relief benefits further strained the nation’s finances.

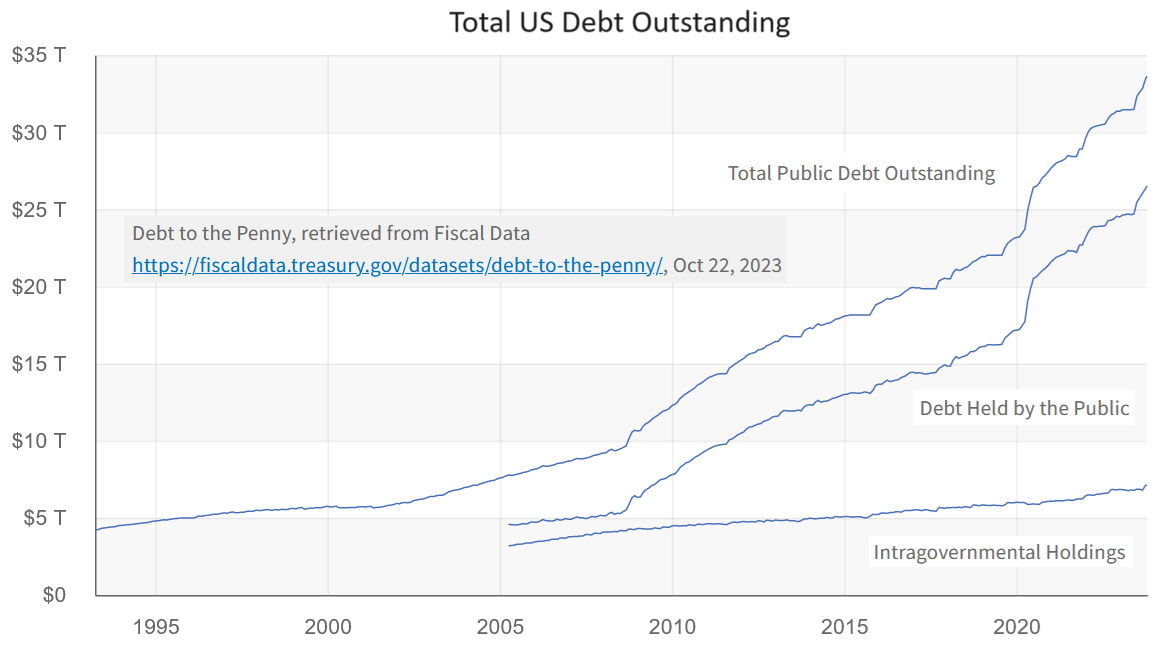

To make up for the deficit, the federal government issues debt. Mathematically, the total outstanding debt is equal to the accumulated deficits plus the accumulated off-budget surpluses.

At the end of September, the national debt stood at $33.2 trillion, a 7.1% increase from September 2022 and a 46% increase from September 2019. With the Fed adopting a 'higher for longer' approach, climbing debt servicing costs are expected to fuel a vicious cycle of increasing interest payments and growing debt in the coming years.

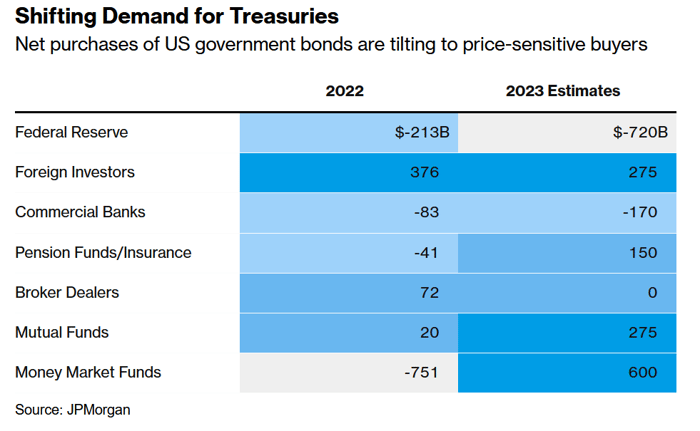

The majority of U.S. debt (80%) is held by the public. Yet, the composition of Treasury buyers has recently shifted, driven by rapidly rising interest rates and the swelling debt level. There has been a transition from long-term focused and steady-handed buyers (such as sovereign governments and commercial banks) to price-sensitive private buyers (such as pensions, mutual funds and hedge funds).

The U.S. will not default on its debt, despite credit rating downgrades and frequent debt ceiling dramas. If these dollar-dominated debts run out of buyers, the Treasury can always step in as a buyer and/or pay off debt by printing unlimited money.

The debt crisis, therefore, is not about default, but about the consequences of unconstrained spending and debt which include inflation and destabilized financial markets. Treasury bonds' new buyers are rightfully demanding more risk compensation in the form of higher term premium.

The 10-year yield serves as a critical proxy for nearly all financial markets. Rising yields can quickly tighten financial conditions, even after the Fed has paused.

Volatility in the bond market will eventually spill over into the equity market. The VIX just began to see a mild backwardation on the front end.

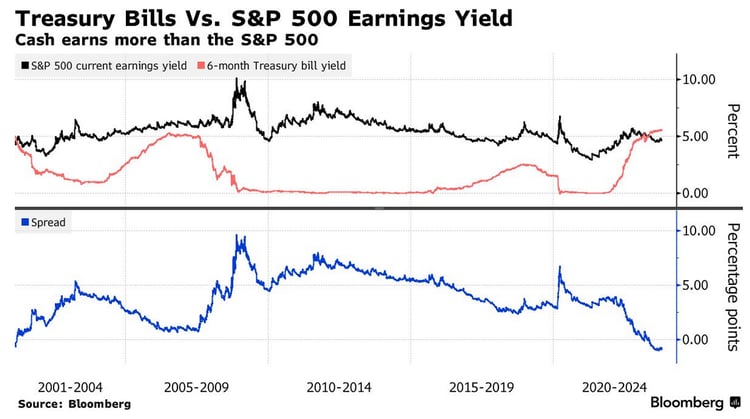

As yields continue to rise, bonds may also deprive stocks and other assets of liquidity.