Jump to conclusion.

Economic, political, and geopolitical factors continue to pose risks, but for now, both stocks and bonds look positive for 2026. As market dynamics evolve, we believe active management and a data-driven approach will be critical.

US Macro Conditions

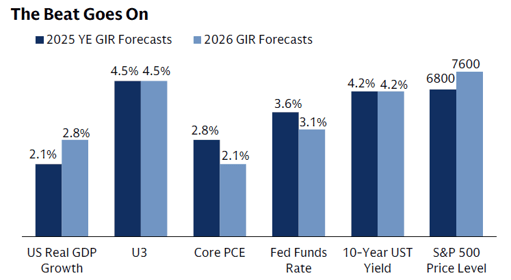

The macro backdrop improved further in January. Expectations for GDP growth and inflation moved in the right direction, while the unemployment rate and the 10-year yield held steady.

However, meaningful risks remain. shifts in economic conditions—including Federal Reserve policy and developments related to artificial intelligence—alongside political and geopolitical events, could quickly alter market sentiment and threaten to tip the balance in financial markets. President Trump’s nomination of Kevin Warsh as Federal Reserve Chair, for example, has prompted a market recalibration that is likely to continue as investors gain greater clarity on Warsh’s policy stance.

Source: Goldman Sachs Asset Management and

Goldman Sachs Global Investment Research (GIR). As of January 12, 2026.

US Equity - Overweight

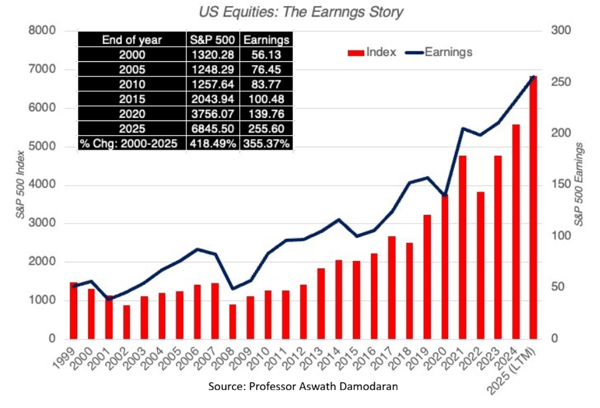

For more than two decades, earnings have consistently driven returns in U.S. stocks. Short-term deviations occur due to shifting expectations, sentiment, and periods of over- or under-reaction, but they do not last.

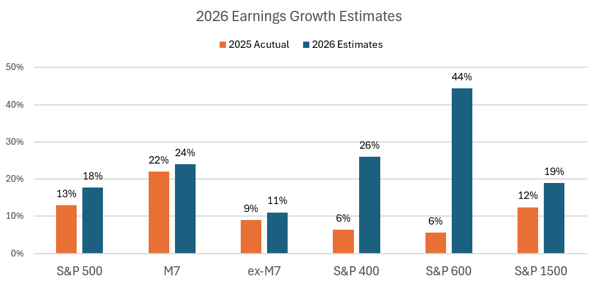

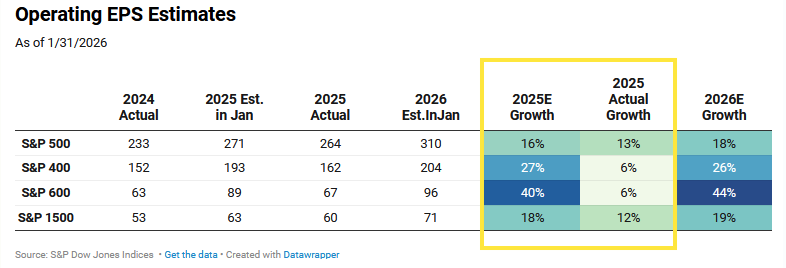

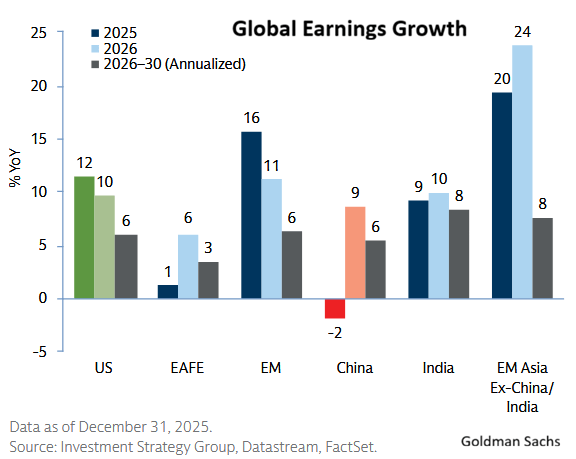

Earnings are very supportive of the US equities into 2026. Large US companies have outearned all their major developed country counterparts and will continue to exhibit faster and more reliable earnings growth.

Source: S&P Global; JPMorgan.

We have less conviction in small- and mid-cap (SMID) stocks’ earnings estimates. At the beginning of 2025, the market was optimistic but ultimately proved excessive about SMID. We believe investors WANT to broaden out, but whether SMID can meet those lofty estimates a second time around will depend on whether economic growth accelerates or decelerates.

International Equity - For Diversification

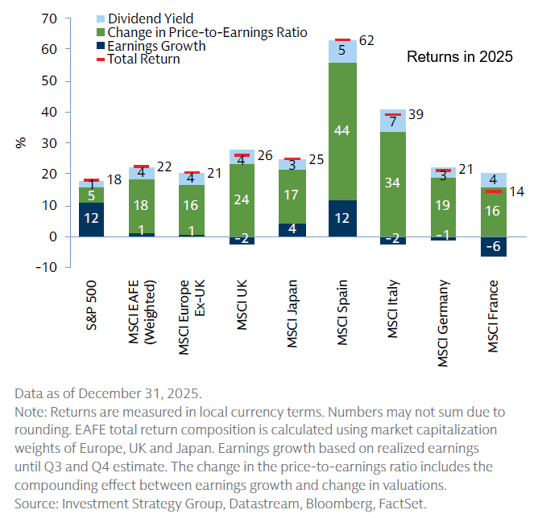

Growth remains strongest in the U.S., where companies have out-earned their counterparts in developed markets by a wide margin. In 2025, Spain delivered earnings growth similar to the U.S., but in most developed countries, equity returns were driven almost entirely by multiple expansion.

We believe the U.S. will continue to provide more stable and reliable earnings growth. However, international equities remain appealing and offer meaningful diversification benefits.

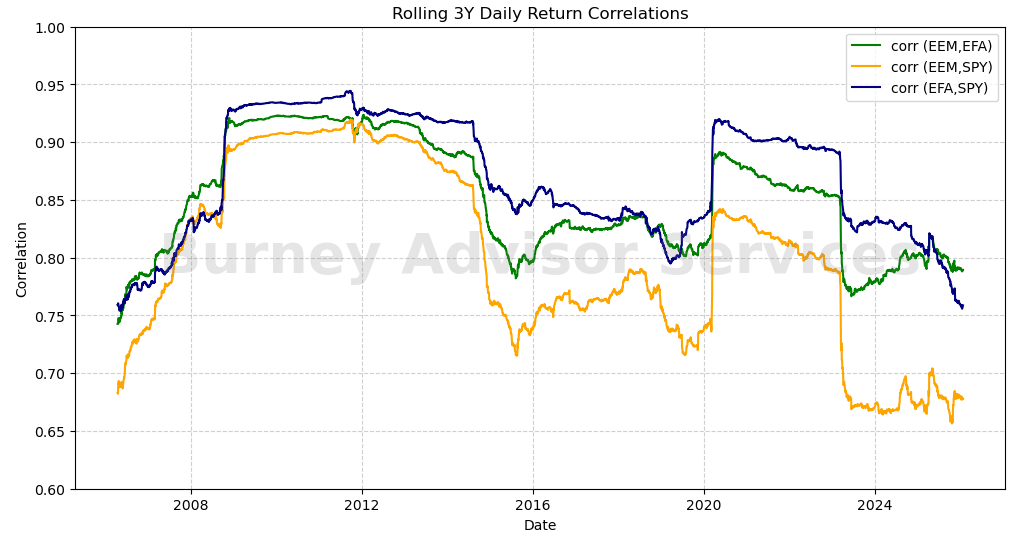

First, correlations between U.S. and international equities have now returned to their pre-Financial Crisis levels, supporting allocations to non-U.S. equities for diversification purposes.

Global equity integration has come and gone, and the pullback in global cooperation continues. Recent elections around the world have favored leaders focused on defending domestic trade, advancing populist agendas, reducing reliance on non-fiscal institutions, and promoting self-sufficiency.

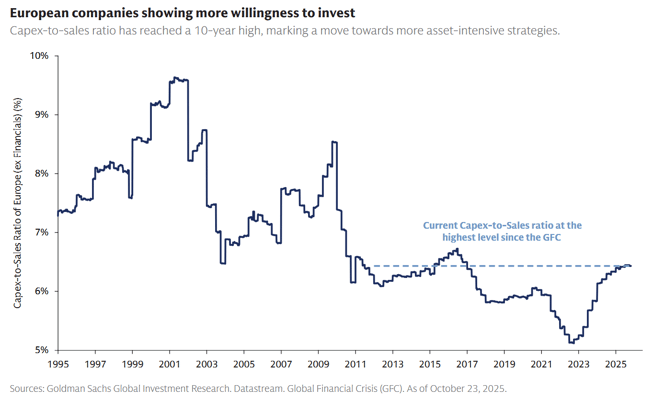

Second, developed markets, in general, are attractive mainly because of their valuations. With geopolitical developments, there are also some up-and-coming growth opportunities.

In Europe, companies have underinvested for two decades and there's renewed spending, driven by the energy transition, security and defense needs, reshoring, infrastructure upgrades, digitalization, and AI, that could provide a meaningful medium-term boost to growth.

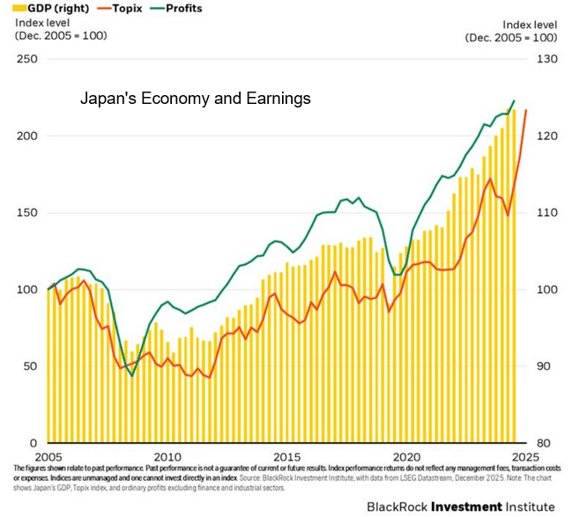

In Japan, the shift away from decades of deflation continues to improve the growth outlook, and the prospect of a super-majority under a Takaichi-led government increases the potential for fiscal support. This would likely facilitate corporate capex and consumer spending, providing a tailwind for Japanese equities.

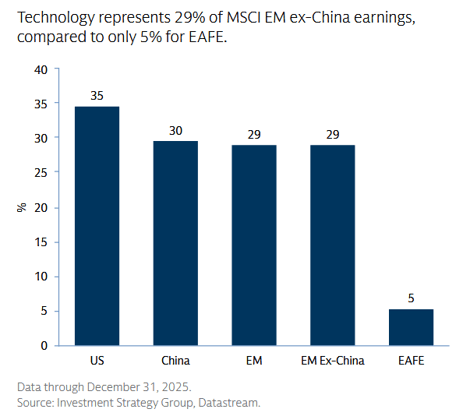

Lastly, beyond their general higher growth relative to developed markets, emerging markets are leading in AI and chip innovation outside of the United States.

Fixed Income

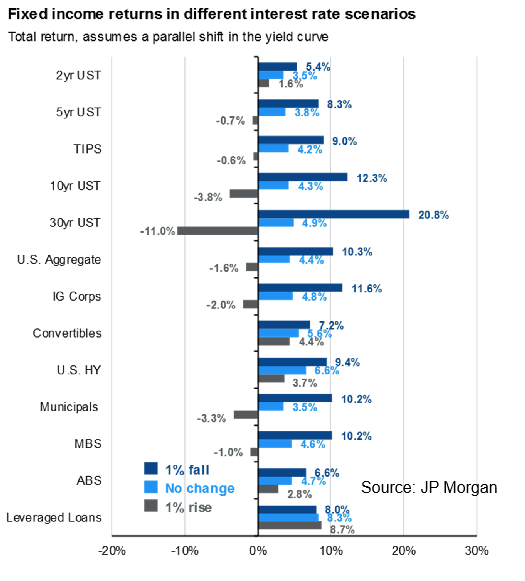

At this point, the path of interest rates remains highly uncertain, and credit spreads are more likely to widen. The market is currently pricing in two Federal Funds Rate cuts in 2026, but longer-term rates will depend on a range of factors, including the debt-to-GDP ratio. Developments such as AI’s economic impact, recessions, and geopolitical shocks could shift the macro backdrop and drive rates meaningfully higher or lower.

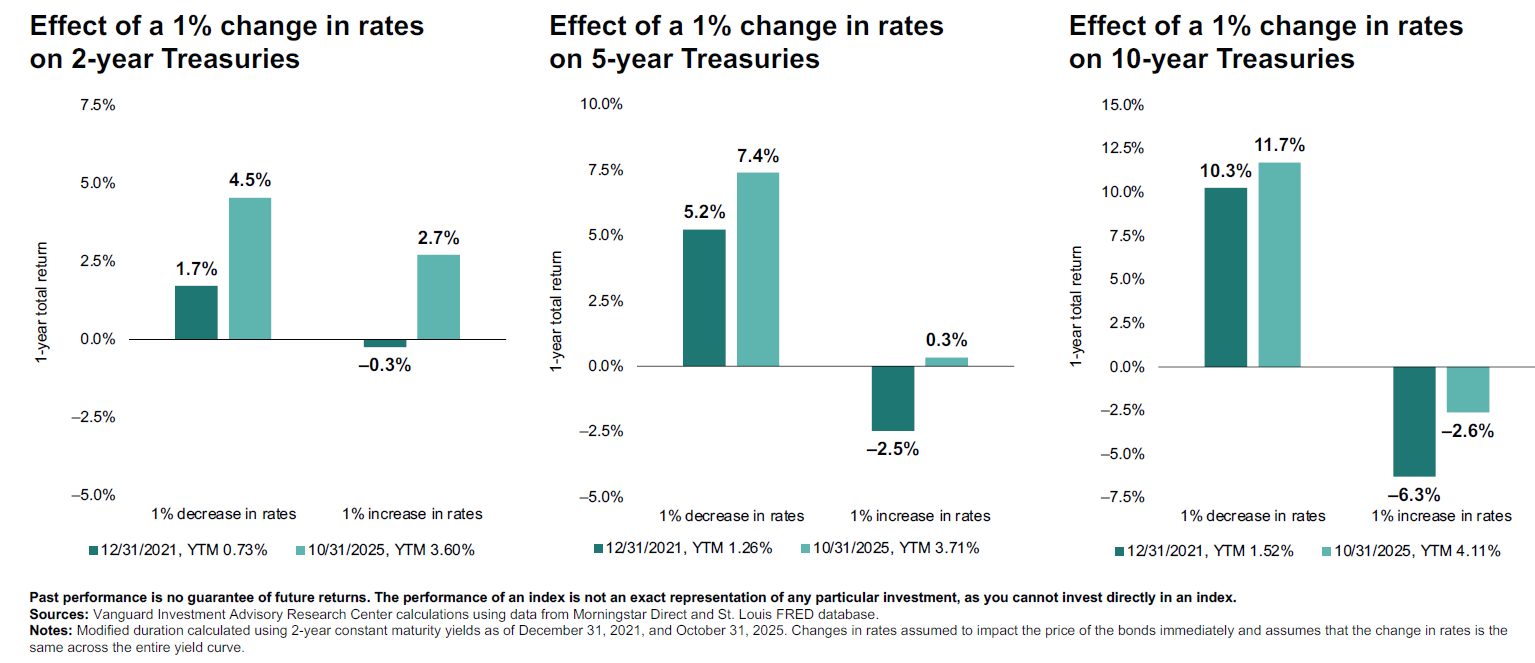

It’s worth noting that, even though there is a risk that rates can still rise from here, we are in a very different position than in 2021. When rates are ultra-low as in 2021, a 1% increase can cause much larger losses in bonds than it would when rates are already around the 4% level.

The current environment, therefore is generally good for bonds, barring a sudden uptick in rates. Active bond funds outperformed in 2025, and we do think they are still where investors should be in 2026.

Conclusion

Stocks and bonds are both well-positioned for 2026, even after a solid year. The strongest earnings growth remains in the U.S., but international equities offer alternative opportunities supported by lower valuations, defense and energy infrastructure spending, as well as AI innovation. Given the uncertainty around the direction of rates and credit spreads, active fixed income management is what investors should consider despite the broadly positive outlook for bonds.

Back to the top.