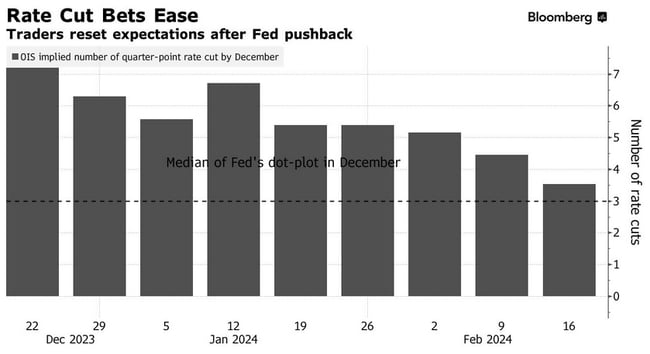

Despite the Fed's consistent signaling of three rate cuts for 2024 in its December and January meetings, the market remained unconvinced and aggressively priced in as many as seven cuts. This changed after January's economic data came in mostly hotter than expected, finally aligning market expectations with the Fed's stance on the number of rate cuts.

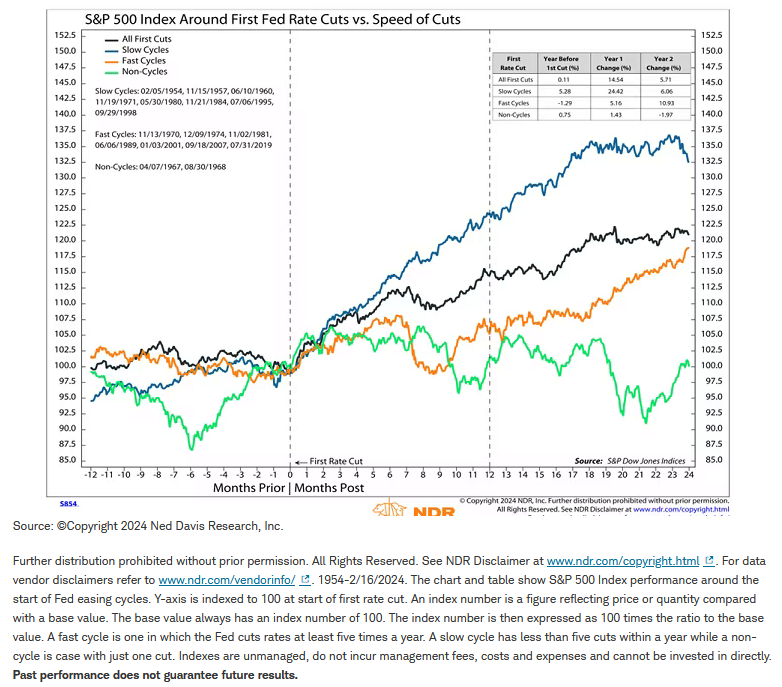

Historically, 'escalator down' rate cut cycles have actually been very good for the stock market. According to recent research by Ned Davis Research covering all cycles from 1954 to February 16, 2024, the S&P 500 generally advanced after the Fed's first rate cuts. When the cuts occurred slowly (2 to 4 times a year), stocks experienced the highest, longest and most steady gains. One potential explanation is that paced rate cuts indicate that no imminent economic deterioration is expected.

The macro backdrop today is upbeat. Q1 GDP growth forecast is a robust and healthy 2.9%, the unemployment rate stays below 4%, core inflation is trending toward 2%, and the probability of recession has declined considerably compared to last year. The U.S. economy is in a good spot and there are reasons for investors to be optimistic about stocks.